This post is part of a mini-series on car sharing and mobility. Read the others here:

- Are taxes hindering car share programmes? Find out which EU country is driving reform

- Are autonomous vehicles really a game changer in sustainable urban mobility?

- Four ICT-based innovations revolutionising car sharing

Ever need to go somewhere but don’t know how to get there? As in, all options just seem to be so complicated? Perhaps you need to hit up IKEA for some new kitchen cabinets (and of course the wall mirror, hanging flower pots, and cutlery purchases you’ll realise you “need” once there). The bus isn’t practical for several reasons: it doesn’t allow you to easily transport everything you buy; the hours aren’t suited to when you need to go; the bus stop is halfway across town in the opposite direction; and you’ll have to wait in line for 90 minutes just to secure a spot on the bus, with no guarantee of having a spot on the bus back (#TrueStory). Your close friend(s) with a car is (are) out of town. It’s too far and expensive to take a taxi. So, you decide to car share (dun dun duuuun!!!)

Congratulations, your first big decision of the day is done. The next big decision is to choose the type of car share programme. This post will hopefully help you with that, so you can say bye-bye to your transport troubles once and for all. It’s important to note that not all cities will give you a choice of car share programmes. Other cities, like Paris, are flooded with options. And while all car sharing organisations struggle to some extent with the same challenges (such as managing peaks in demand relative to supply), they can be classified into five main types of business models:

- Free-floating with an operational area

- Free-floating with pool stations

- Roundtrip home-zone based

- Roundtrip station-based

- Peer-to-peer (P2P)

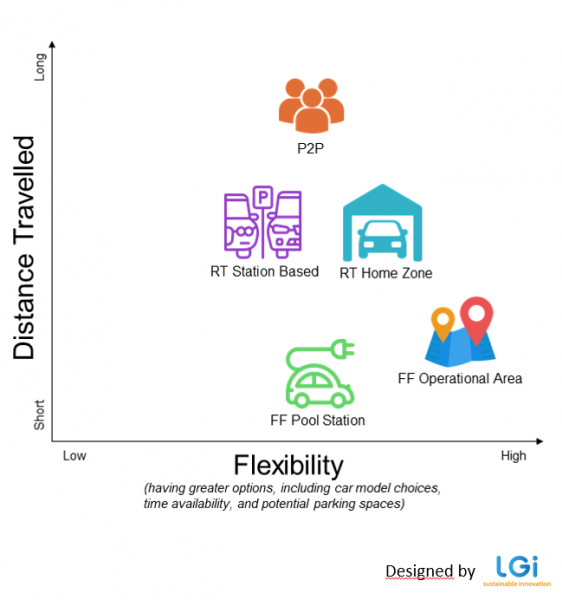

Each business model comes with its own distinct characteristics, pricing habits and tendencies, which contribute to the user appeal of an organisation. For (potential) drivers wanting to get to point B, two major factors to consider are:

- Distance travelled (both in terms of how far drivers can theoretically go, as well as how far the average driver tends to go)

- Flexibility (defined here as having greater options—this includes car model choices, time availability, and potential parking spaces. While such dimensions are indeed influenced by the business model classification, this factor will also depend upon a driver’s individual circumstances and the specific features of an organisation.)

We have mapped the business models based on where they fall along these two axes (Note: Car sharing is rapidly-evolving market, so this image will not remain static. Competition is forcing business models to adapt, and those that adopt new, user-friendly technologies will no doubt gain in terms of both flexibility and distance):

Never heard of these? No worries, here’s a brief description of how each business model plays out:

- Free-floating with an operational area: members of a car sharing organisation choose an available car nearby and then return it by leaving it in any valid parking spot within a defined district. Drivers have the freedom to make one-way trips and have more parking options to choose from. However, both the free-floating factor and the area/zone-based aspect are designed more for inner-city travel, so distance tends to be restricted when compared to the others.

- Free-floating with pool stations: members choose a car from a pool station and return it to one of the pool stations spread across the city. Organisations that operate under this business model are perhaps the rarest on the market. They are currently heavily influenced by electric vehicle (EV) networks, making the distance travelled confined to the life of the battery and the charging point locations. Most are not yet profitable. For the cars to be able to go their maximum distance, downtime is required for the batteries to sufficiently recharge, and users must wait for them to do so. This limits the degree of flexibility drivers would otherwise have. Likewise, although the free-floating aspect offers some degree of flexibility, providing drivers with the choice of making trips from point A to point B, the station-based aspect means that drivers must go to a set location to park, taking away their flexibility in terms of parking choices.

- Roundtrip home-zone based: members must return the car to the general area from which they started. This is similar to a neighbourhood business model, where the vehicles are often located in residential areas, for use by local residents. While the roundtrip aspect means that drivers do not have the flexibility to take one-way trips, the area/zone-based aspect means that cars can be parked in any valid spot, as long as it is within the same zone or neighbourhood as that of the departure. This business model therefore provides users with some degree of flexibility in terms of where they park the car. In terms of distance, it is a bit of a mix. While the area/zone-based aspect works best in compact urban areas, the roundtrip aspect means that users can still travel longer distances. Likewise, both the distance and flexibility can vary, depending upon the fleet’s specifics (such as if there are electric vehicles).

- Roundtrip station-based: members choose a car from a station and then return it to the same station. Both the roundtrip and the station-based aspects mean that this model lacks flexibility, as the cars must be returned and parked at the departure station. In general, this business model tends to be for longer, less frequent/mundane drives, so it ranks fairly high in terms of distance travelled.

- P2P: P2P organisations operate much like roundtrip organisations, only it’s the car owners’ own cars that get rented out, rather than an organisation’s vehicle fleet. This allows anyone with a car to make money by renting it out when it would otherwise be sitting idle. When drivers are done with the car, they return it by driving it back to the car owner’s home or home-zone area. Where they return it will often depend upon the size of the city in which the P2P organisation is operating, as many car owners in big cities may not have private parking spaces, and drivers will therefore park it on public streets nearby (essentially making it area/zone-based). While a hodgepodge of members’ cars offers members great flexibility in driving options, the options will depend on what the car owners have. The same goes for the time availability of the cars, although there are very successful organisations with this business model that cater to both, short- and long-distance trips. The only downside is that these organisations have traditionally required a physical key to open the cars, and users may find that arranging for the key swap and meeting the car owner is time consuming and less flexible. While many P2P organisations promote the social aspects of getting to know the other members, many are now offering technology platforms that allow drivers to bypass this step, offering them instant chip card or mobile access. For these reasons, the P2P business model offers drivers a medium degree of flexibility overall. This flexibility includes giving drivers freedom to travel on longer trips than their counterparts, putting them at competition with daily car rental companies.

Understanding how the business models operate can help you decide which programme will better meet your trip needs. It is often a matter of personal preferences, and pricing varies depending upon the brand and branch within a business model. The only “wrong” choice is if you were to choose an electric car share programme to travel to a far-away point B that has no charging infrastructure, in which case you may find yourself hitchhiking home and with a hefty tow bill to pay.

So what about that IKEA trip of yours? Being that IKEA stores tend to be located outside of the city with few public transport options and sometimes little EV infrastructure, you would most likely want to choose a roundtrip or P2P car sharing organisation for your trip.

SUZI TART MAURICE

Head of Communication & Design

Meet me on LinkedIn

The views and opinions expressed in this blogpost are solely those of the original author(s) and/or contributor(s). These views and opinions do not necessarily represent those of LGI or the totality of its staff.

FOLLOW US