What do you do when your pet cat suddenly stops eating? You would likely seek immediate help, investing in its health because it’s necessary, it brings you joy when your cat feels better, and the vet, like any professional, receives fair compensation.

Now take a step back: At a (much) larger scale, the global economy relies on biodiversity at an estimated USD 125 tn. to USD 140 tn. of its total value created per year (World Economic Forum & PwC, 2020): “The “Total Economic Value of Ecosystem Services” […] is nearly twice the global GDP”. We also know that the annual estimated cost of biodiversity loss could reach USD 14 tn by 2050, equivalent to 7% of expected global GDP in that year. Yet, as many now recognize and despite its importance, the UN estimates a biodiversity funding gap (the amount needed to protect and conserve biodiversity) of USD 711 bn per year until at least 2030 (UNEPFI, 2022). This significant shortfall is akin to our beloved pet cat being unwell: Investing in biodiversity, like investing in our pet’s health, is necessary, brings joy (Environmental Conservation), and generates substantial financial returns.

To mend that gap and unlock finance for biodiversity, we all need to recognize its importance, use the same terminology, work with public and private investors alike – and have a bit more empathy.

Decoding biodiversity finance: The power of a shared taxonomy

It’s clear that unlocking finance for biodiversity requires a multi-faceted, multi-stakeholder approach. The first step in that direction is the establishment of a shared taxonomy in biodiversity finance to serve as a common language for investors, policymakers, and scientists to effectively communicate and align investments with biodiversity goals (Veltman & Cholo, 2020). Just as a concerned pet owner would seek a to understand the veterinarian’s jargon about their cat’s health, establishing a shared taxonomy in biodiversity finance is crucial. Leading the charge, one of Europe’s main finance-related endeavours in the EU Taxonomy, of which aims to align investment flows with nature-first interests and to make explicit the risks associated with such investments. The current lack of a shared taxonomy for biodiversity finance has significant implications (Layman et al., 2023):

- Incomplete and untested models: Without a shared taxonomy, the links from activities to impacts are incomplete and omit critical information. The models that use these links are largely untested for use in portfolio construction, which leads to the investment community focusing on biodiversity without sufficient forethought, thereby risking the entrenchment of metrics with significant flaws.

- Treating symptoms, not causes: There’s a risk of treating the symptoms of biodiversity decline without addressing underlying causes. This is particularly concerning in regard to the previous point.

- Data quality and coverage: Creating metrics for positive and negative biodiversity impacts is challenged by data quality and coverage: while the IUCN Red List data are relevant for assessing impacts in terms of species risk status, they are limited by the lack of explicit reasoning that links threat assessments to the extent of business impacts.

- Biased and lacking spatial resolution: All biodiversity metrics are biased taxonomically and lack the spatial resolution necessary for effective application to site-level business activities.

If well implemented, including work with the right stakeholders early into its design, such a taxonomy will provide a holistic perspective for investors, encourage behaviour change in businesses, and ensure that the focus is on addressing the root causes of biodiversity decline rather than just the symptoms.

Blended Finance: The financial panacea for biodiversity

While climate services, in particular biodiversity-related, are critically important to (1) our survival and (2) our economic and democratic longevity (Twining-Ward et al., 2018), it’s mostly seen as risky business; as a result, “risk” is mostly carried by the public (through grants, mostly), while private investors and asset holders are staying on the safe side by focusing on more obvisouly ROI-generating positions.

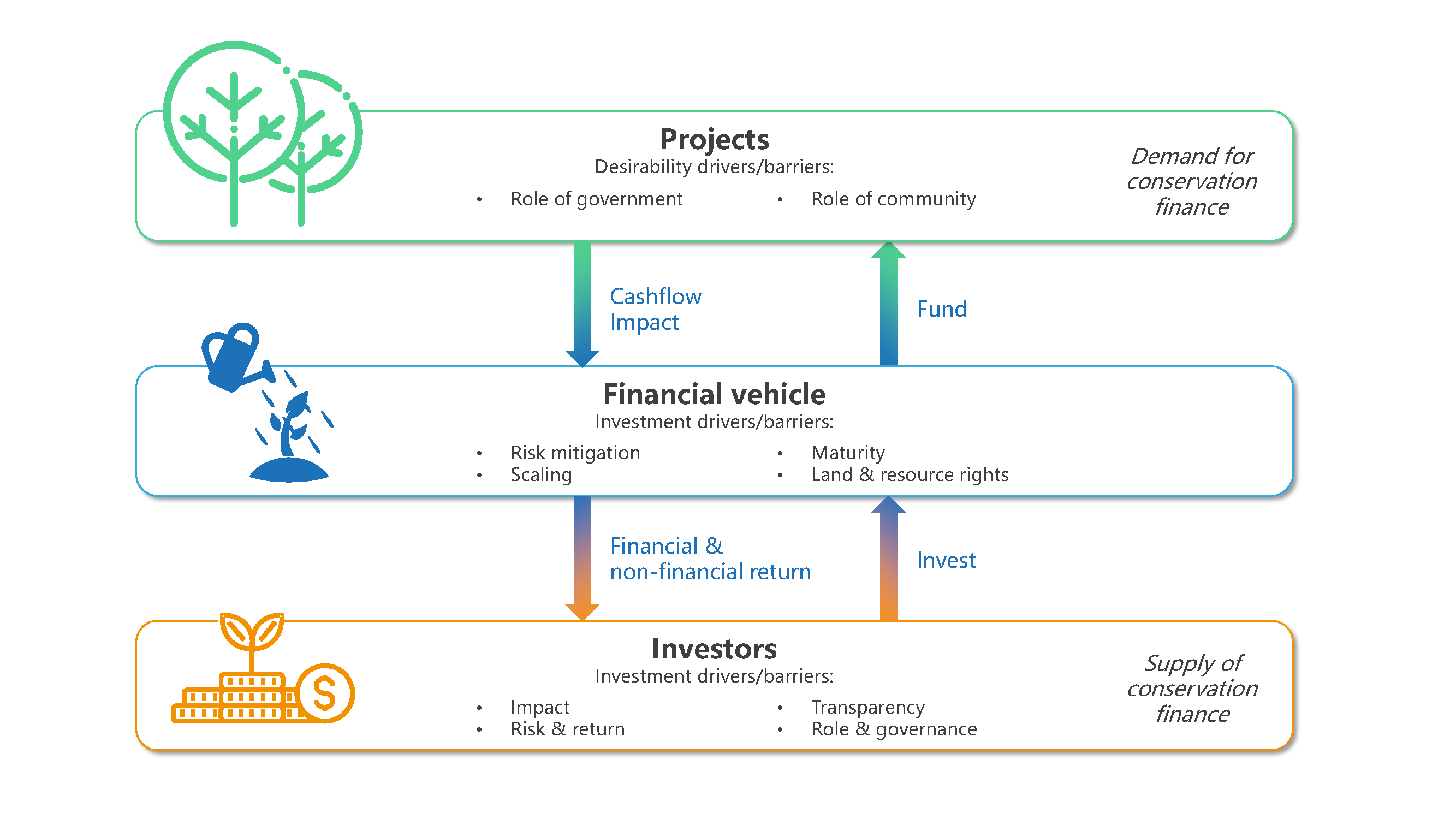

Enter blended finance mechanisms, which make use of public or philanthropic funds to attract private sector investment in sustainable development, thereby addressing the funding gap for critical projects, including those focused on biodiversity conservation. Consider the use of blended finance mechanisms as the equivalent of a pet insurance policy: In the context of biodiversity-focused projects, blended finance plays a pivotal role in reducing risks for all involved parties by combining different financial instruments (concessional capital, guarantees, insurance, and technical assistance funds) to unlock private sector capital. In overview, it typically involves a layered financing structure where the public or philanthropic capital takes on the higher-risk layers of the investment, thereby protecting the private investors from initial losses (OECD, 2019; OECD & World Economic Forum, 2015; Smith et al., 2022).

Figure 1 Risk layering and misalignment of priorities in conservation finance (adapted from Smith et al., 2022)

However, the critical ingredient for successful blended finance transactions is the potential for viable revenue streams to pay back the return-seeking capital – highlighting the importance of developing sustainable business models for biodiversity conservation projects. One real-life example of this is tourism, which can be leveraged to finance protected areas by implementing models of nature-based tourism – already a successful approach in Botswana, India, Kenya, and South Africa, which has contributed to both economic growth and biodiversity conservation (Ben Jebli et al., 2019; Twining–Ward et al., 2018).

Biodiversity Investments: The Path to Prosperity and Preservation

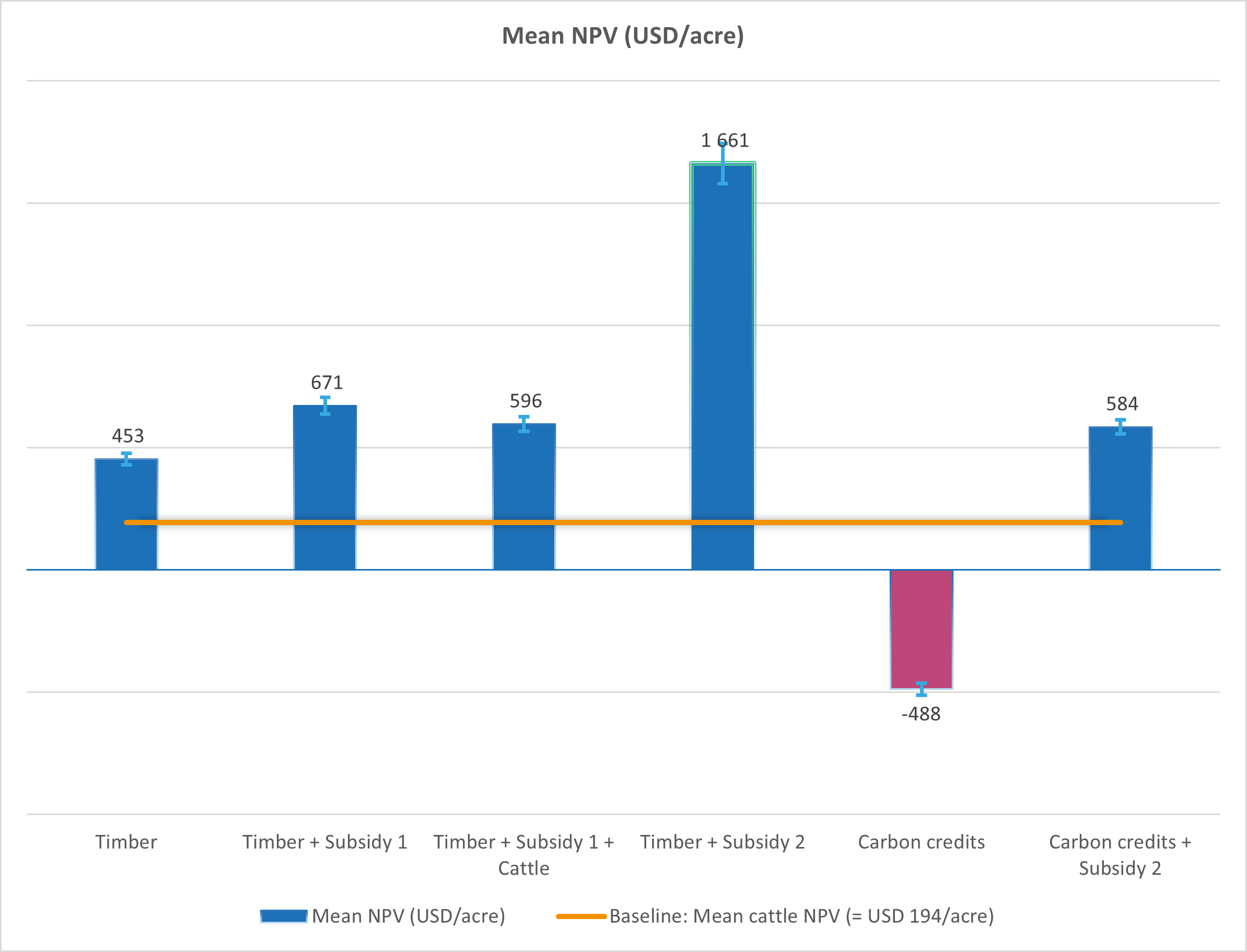

It’s therefore clear that private investors can also have a role to play to bridge the biodiversity funding gap and drive innovation in biodiversity finance. It’s great business too: investing USD 45 bn per year towards biodiversity conservation could generate a return of USD 4.5 tn in new economic activity (UNEP, 2019). Biodiversity investments can generate substantial returns, both in terms of financial gains and positive environmental impacts. Going back to our sustainable wildlife tourism as an example, it has been shown to provide economic benefits to local communities and generate government revenues, all the while contributing to conservation efforts. And there is a plethora of business models that are applicable around projected areas and conservation projects, offering as many alternative Net Present Values, or NPV (in other words, tomorrow’s ROI adjusted to today’s investment, based on the value return of the risk taken by the investor); interestingly, carbon credits alone, while being the most widespread “business model” for nature-based solutions, are starting to be disproven as an impactful and rewarding structure.

Figure 2 NPV potential (USD/acre) across multiple business strategies for private land (adapted from Goldstein et al., 2006, standard error (5%) applied)

There are also potential environment social governance (ESG) and regulatory risks down the road, for all direct and indirect investors and facilitators (looking at you, insurance). For example, the EU has proposed the Nature Restoration Law, recognising that “Every €1 invested into nature restoration adds €8 to €38 in benefits”, putting biodiversity at the same commitment level as carbon emissions (European Commission, 2023). This is in direct relation to the still–recent international agreement to implement the Kunming-Montreal Global Biodiversity Framework from COP15 (European Commission, n.d.), resulting in a surge in country-level targets and financing schemes for biodiversity. You can track EU-level biodiversity strategy actions on the European Commission’s dedicated tracker.

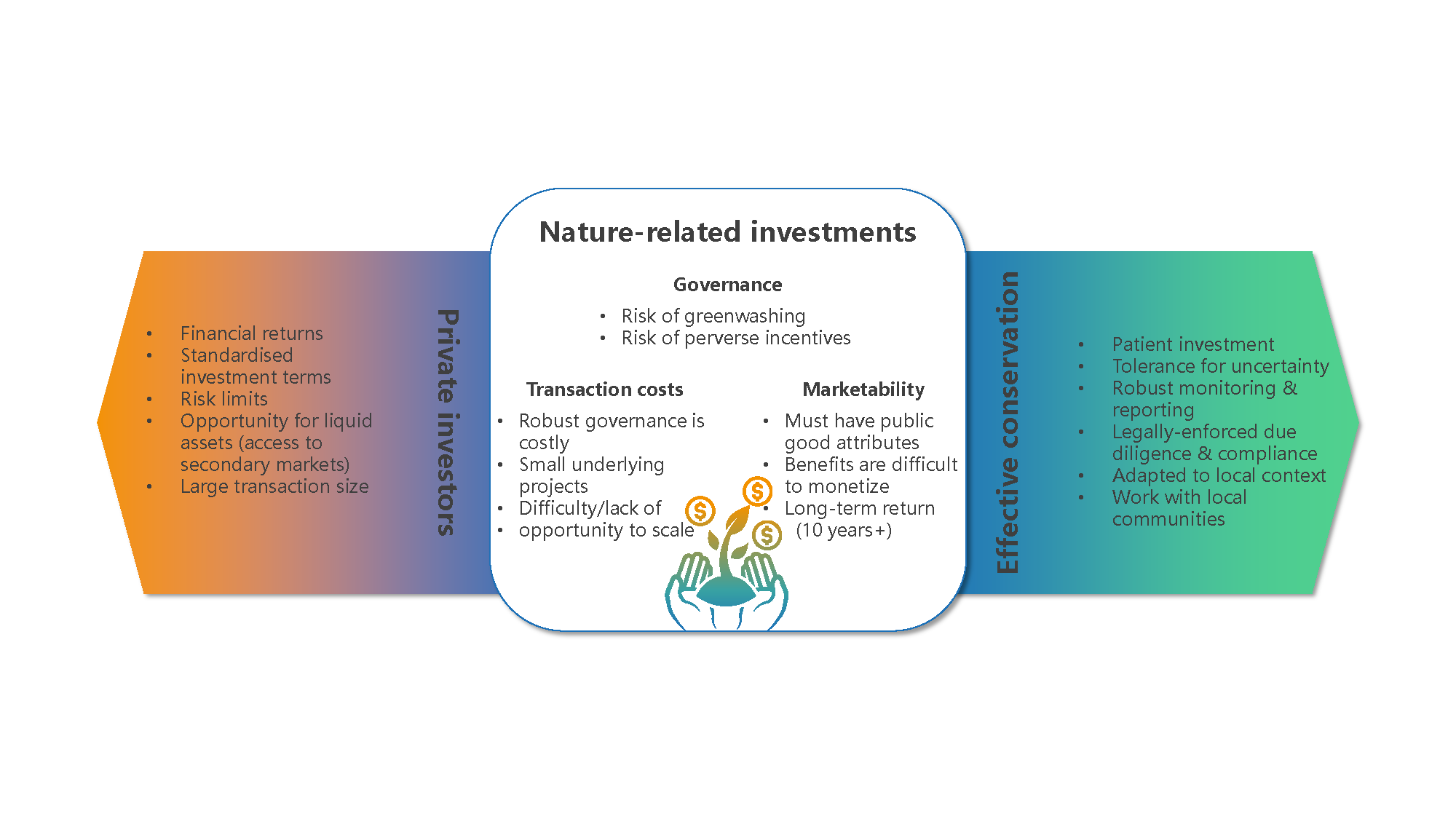

Figure 3 Antagonisms between conservation and financial investor outcomes (adapted from Kedward et al., 2023)

Of course, public bodies play a pivotal role in biodiversity finance thanks to their impact through incentives and clear regulatory frameworks, together promoting transparency and accountability. Historically, oversight mechanisms have been driven by private sector initiatives, leading to conflicts of interest and instances of ‘greenwashing’ – which now demonstrates that a proactive oversight role for public bodies is needed to ensure robust ecological outcomes. It’s in their interest: The economic case for public conservation funding remains strong, with the gains in economic welfare from biodiversity protection likely outweighing the costs of public intervention, while the creation of green jobs can generate political legitimacy for increased public spending on conservation. As adverse environmental trends increasingly affect our productive systems, there have been growing calls for ambitious mission-driven public policy, such as ‘Green New Deals’. These initiatives underscore the importance of a strong partnership between public bodies and private investors in financing biodiversity projects. In the context of blended finance, public bodies can play a crucial role in ‘de-risking’ conservation projects. However, such de-risking may represent an overly expensive use of government investment capacity; effective public oversight is therefore needed to ensure that these mechanisms are cost-effective and genuinely contribute to biodiversity conservation, rather than primarily serving as revenue streams for private actors.

Caring for biodiversity requires a shared understanding, financial mechanisms akin to pet insurance, the involvement of private investors, and a focus on both risk mitigation and opportunity exploitation. By adopting these strategies, we can ensure that biodiversity, like our pet cat’s health, receives the investment it needs to thrive. Now, it may look like we’re calling for an all-out capitalist approach to biodiversity conservation; however, the focus is on sustainability: Prioritising conservation investment based on the return on investment has shown to protect between 32% and 69% more species and up to three times more distinct vertebrate species, compared to other priority-setting approaches.

Pierre Cattoire

Senior Sustainable Innovation Strategist

Meet me on LinkedIn

The views and opinions expressed in this blog post are solely those of the original author(s) and/or contributor(s). These views and opinions do not necessarily represent those of LGI or the totality of its staff.

FOLLOW US